Roles

Fraud Prevention Solutions for CFOs

TrustPath empowers CFOs to protect assets, cut fraud losses, and ensure compliance with advanced fraud prevention.

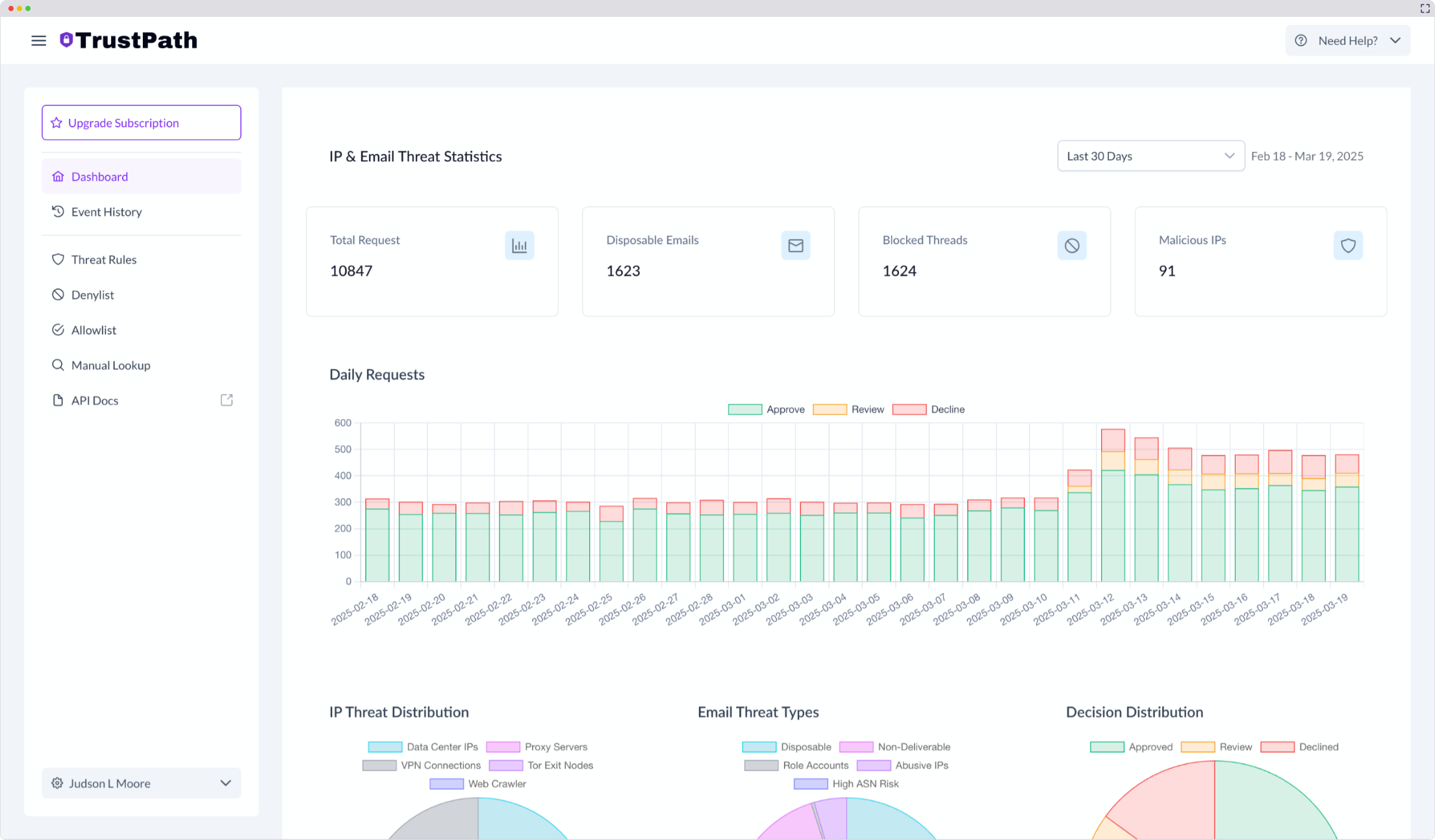

OUR TECHNOLOGY

How TrustPath protects your transactions

Analyze

Real-time transaction monitoring and risk assessment.

Detect

Fraud pattern recognition and behavioral analysis.

Prevent

Automated blocking of suspicious transactions while allowing legitimate ones.

CFO Solutions

Protect Your Bottom Line with Advanced Fraud Prevention

TrustPath provides the visibility and control you need to identify fraud risks, reduce financial losses, and maintain regulatory compliance across your digital operations.

- Reduce financial losses. Prevent payment fraud, account takeovers, and promotional abuse that directly impact your bottom line.

- Improve financial forecasting. Gain visibility into fraud patterns and trends to better predict and manage financial risks.

- Optimize operational efficiency. Reduce manual review costs and streamline fraud management processes.

Benefits

Financial Protection Through Advanced Fraud Prevention

TrustPath helps CFOs protect financial assets, reduce operational costs, and ensure regulatory compliance with minimal impact on legitimate customer experiences.

Protect Revenue Streams

Prevent payment fraud, chargebacks, and promotional abuse that directly impact your bottom line.

Reduce Operational Costs

Decrease manual review costs and streamline fraud management with automated risk scoring.

Ensure Regulatory Compliance

Meet financial regulations with comprehensive fraud monitoring and detailed audit trails.

Frequently Asked Questions

-

TrustPath identifies and blocks fraudulent transactions, account takeovers, and promotional abuse in real-time, directly protecting your revenue streams and reducing fraud-related losses.

-

Yes. TrustPath provides comprehensive fraud monitoring, detailed audit trails, and risk assessment tools that help meet AML, KYC, and other financial regulations.

-

By automating fraud detection and reducing false positives, TrustPath decreases manual review costs, streamlines fraud management processes, and improves operational efficiency.

-

No. TrustPath works transparently in the background, allowing legitimate customers to transact normally while only flagging truly suspicious activities.

-

Most CFOs see measurable ROI within the first quarter after implementation, primarily through reduced fraud losses, decreased chargebacks, and lower operational costs.

Trust

Security & Compliance

We maintain high security standards and aim to comply with major industry regulations and frameworks.

Protect Your Business

Schedule a demo with our fraud prevention experts to see how TrustPath can secure your transactions. Get personalized insights into your specific fraud risks.

- • Need help assessing your fraud exposure?

- • Want to understand our detection capabilities?

- • Looking for custom fraud prevention strategies?

Engin Yöyen

Co-Founder